Spring selling season is officially here and this is what we’ve seen in the market only three weeks in:

- A slow start with only 1,814 homes taken to auction in the first week

- The second week slowly picked back up with 1,920 auctions held across the combined capital cities, which was impressively up from 1,453 at the same time last year

- This past weekend saw 2,190 auctions, that being the busiest auction week since late June.

With constant noise around interest rates, the property market and inflation, it’s important to note that there is still opportunity for first home buyers, investors and subsequent buyers.

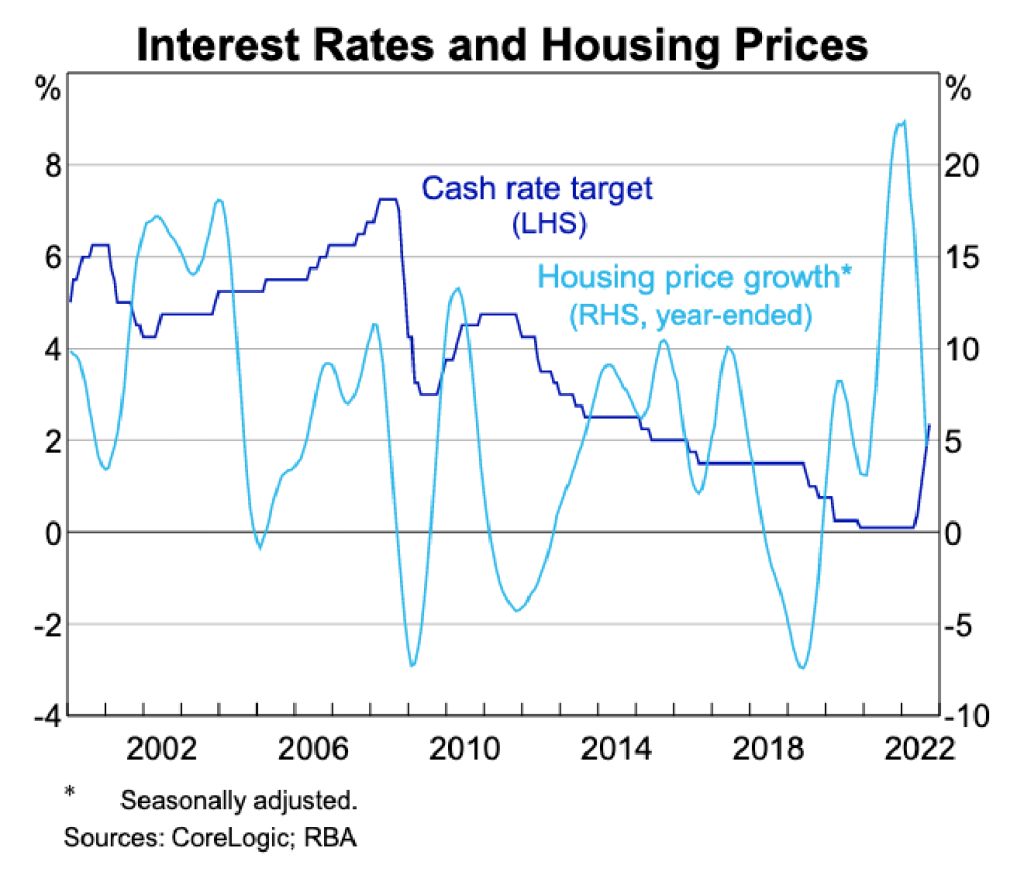

Jonathan Kearns, Head of Domestic Markets at RBA recently stated that:

“The property market influences economic conditions and so indirectly affects interest rates. Housing constitutes around half of households’ wealth. With increased housing prices people feel richer and so spend more. The increase in housing equity means home owners can refinance their loan or borrow more to finance consumption. Also, higher housing turnover – which tends to go hand in hand with rising prices – results in increased spending on real estate services, removalists, durable household goods and so forth. And a property upturn increases investment; owners spend more on renovations and buyers are more willing to put down a deposit, which means developers find it easier to get finance to commence a project. Of course, when prices are falling the opposite of these effects occur.”

Rising interest rates puts pressure on buyers borrowing capacity, confidence and spending habits with the result often being decreased house prices.

Whilst we’re not expecting it to be the spring selling season we’ve seen in recent years, purchasers can leverage the opportunity of the seasonal increase in listings and auctions as well as the pressure that is on vendors to be more flexible on price.

Thinking of getting your foot in the door on a new property? Book a consultation with us today!

Disclaimer: Any information provided herein is of a general nature only. No consideration has been taken into your objectives, needs or financial situation. Before acting on this information you should consider if it is appropriate for your situation.